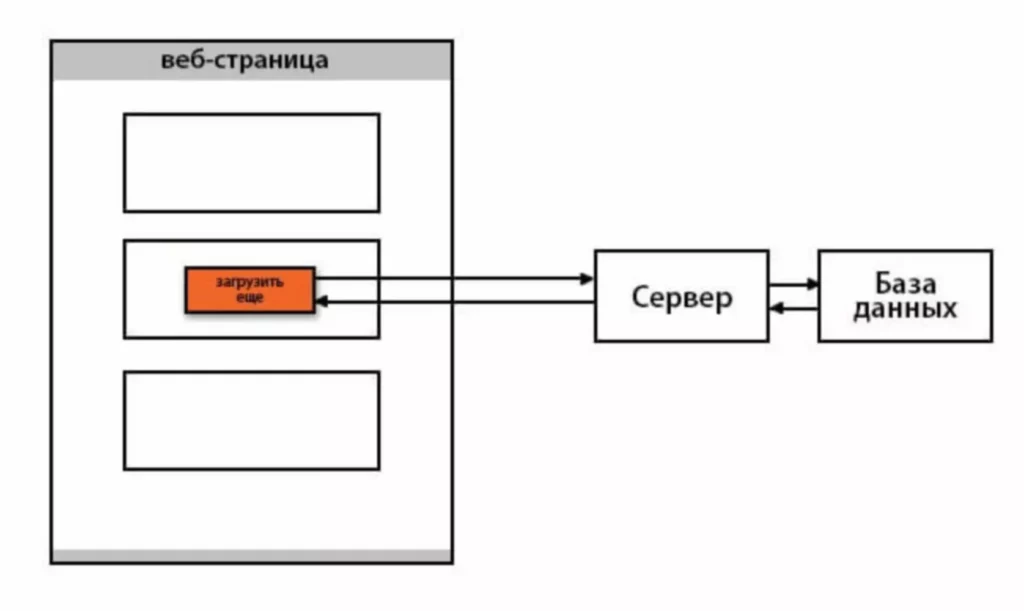

As A Result Of every order is totally different, an strategy that labored for somebody won’t be one of the best for others. Trade Processor supports six different aggregation sorts, every focusing on a unique state of affairs and serving to the broker get one of the best pricing attainable. In line with the Belief Project guidelines, the academic content material on this website is offered in good religion Broker and for basic data purposes solely.

While it’s presently targeted on TON, Omniston is constructed with a cross-chain future in thoughts. Soon, users and developers will have the power to tap into liquidity throughout a number of blockchains via a single, seamless interface. This risk management function acts as a safeguard for brokers, ensuring uninterrupted trade execution even during unexpected technical points.

BeInCrypto prioritizes providing high-quality info, taking the time to analysis and create informative content material for readers. While partners might reward the corporate with commissions for placements in articles, these commissions don’t influence the unbiased, sincere, and helpful content creation process. Any action taken by the reader based mostly on this information is strictly at their own risk. Please notice that our Terms and Circumstances, Privacy Coverage, and Disclaimers have been updated. This is an initiative by STON.fi designed to engage and reward community members who contribute to the platform’s growth and visibility. Ambassadors, known as Stonbassadors, play an essential role in connecting STON.fi with the broader community.

.jpeg)

Conversely, when stablecoins are redeemed, the bridge burns them and releases USD. Utilizing the CBDC liquidity bridge, they convert digital yuan to digital euros immediately, enabling easy payments during their journey. Remember, profitable liquidity bridge deployment involves collaboration, technical expertise, and a deep understanding of both https://www.xcritical.com/ supply and target chains. Bridges maintain a peg between the native asset and its representation on the opposite side.

Straight Via Processing or STP brokers provide traders with direct access to the interbank market. In Contrast To market makers, true STP brokers don’t take the alternative side of their clients’ trades but instead route orders on to liquidity suppliers (LPs) for execution. These case research demonstrate that liquidity bridges play a pivotal function in modern monetary ecosystems.

Key Options To Search For In An Stp Bridge

In addition to its native token, STON.fi enables you to swap a wide range of property and has formed strategic partnerships throughout the TON ecosystem and beyond. Portfolio diversification lessens overall risk by minimizing losses from unfavourable junctures in any single currency. And capitalize on opportunities in several markets which could boost returns. A partnership with LPs makes it easier for brokers to fulfil numerous trade proposals, bringing in additional purchasers and improving their business. Here the broker itself acts as the LP, on this model, the broker takes the alternative side of the commerce.

Entry to capital is essential for merchants and buyers in Forex as a end result of it facilitates massive trade sizes which may result in bigger returns. When brokers leverage on this it offers valuable insights and funding guides they might offer their clients. When LPs partner with brokers they can disperse their analysis to a wider audience, strengthen their market presence, and appeal to new purchasers.

Ecn Bridge

This permits traders to enter and exit positions shortly and efficiently. LPs present a pool of assets (stocks, currencies, and so forth.) open for getting and promoting, guaranteeing easy transactions with out vital value fluctuations. Finxsol doesn’t engage in, promote, or symbolize activities involving investments, buying and selling, hypothesis, or other money-handling companies. An essential aim of an FX bridge is to facilitate a seamless transmission of trading orders and market-related information between the buying and selling platform and the liquidity suppliers.

- Core liquidity bridges function a significant hyperlink between traders and various financial markets, enabling seamless entry to liquidity across different asset classes and geographical regions.

- Customers can stake tokens, participate in liquidity farming, or be part of the Stonbassadors and referral packages.

- Liquidity aggregation is not merely a technical time period; it represents a fundamental shift in the dynamics of foreign currency trading.

- Through brokers, LPs get restrained channels to succeed in shoppers who trade with bigger volumes thereby producing more fees.

- The major difference between liquidity bridges and gateways is their nature.

This connectivity gives traders instant access to real-time pricing knowledge, enabling them to efficiently carry out their trades, obtain instant trade confirmations, and entry other relevant info. Aave, a leading DeFi protocol, makes use of a bridge to connect its Ethereum-based platform with the Avalanche community. Omniston simplifies this process by offering entry to deep liquidity and competitive swap charges throughout a spread of sources, all through a single integration. Anybody can create a pool; however, no one has control over the pool’s belongings or functionality, a design that protects users. STON.fi is a number one AMM protocol that enables customers to swap tokens permissionlessly without intermediaries.

.jpg)

Selecting the proper liquidity aggregator is a decision of paramount significance, one that may considerably influence a trader’s success and profitability. To navigate this crucial decision-making process, traders should consider a myriad of factors, every serving as a compass guiding them towards the optimum alternative. The inside workings of liquidity aggregation are as intricate as they are impactful, orchestrating a symphony of liquidity across an unlimited and interconnected ecosystem. Brokers must select a bridge that aligns with their business model and supplies optimal execution quality.

These bridges facilitate the seamless flow of capital, enabling efficient transactions and liquidity provision. In this section, we delve into the intricacies of liquidity bridges, exploring their significance, mechanics, and practical functions. The A-Book execution mannequin, also referred to as Straight By Way Of Processing (STP), involves transmitting consumer orders directly to the market without intervention from the dealer. In this model, brokers act as intermediaries, executing trades on behalf of their purchasers by matching orders with liquidity suppliers or other market participants. GHI Hedge Fund, recognized for its proprietary buying and selling algorithms, sought a liquidity bridge provider that allowed them to customize order routing rules based on their complex strategies.

.jpeg)

These bridges act as a significant link between different buying and selling platforms, enabling traders to execute trades effectively and successfully. In this section, we will delve into the key features and functionality of Core Liquidity Bridges, exploring their significance from a quantity of perspectives. One of Liquidity Bridge’s key advantages is its advanced order routing capabilities. Brokers achieve access to an unlimited community of liquidity suppliers, allowing clever order routing based mostly on predefined rules and market circumstances. This ensures competitive pricing, lowered slippage, and enhanced order success.